Private schools oppose new BIR tax rule

FEU Advocate

June 10, 2021 10:50

Several private schools, including Far Eastern University (FEU), stood in solidarity with the Coordinating Council of Private Educational Associations (COCOPEA) to demand an amendment from the Bureau of Internal Revenue (BIR) with its recent provision of the Revenue Regulations No. 5-2021 (RR 5-2021) which mandates an increase of tax rates on private educational institutions.

In COCOPEA's statement released June 1, the association stressed that the 10% to 25% tax increase will only cause "irreparable damage to the institutions and stakeholders" and "further impose a burden to the private education sector" considering that the universities are still in distraught after its transition to online classes.

According to the Department of Education (DepEd), around 900 private basic educational institutions have closed for the Academic Year 2020-2021 while the enrollees in K-12 schools dropped by 900,000—leaving a devastating decline in the education sector.

On the other hand, the Philippine Association of Colleges and Universities (PACU) in April reported that there's a 10-50% decline in the enrollment of most institutions in higher education.

With the data given, COCOPEA believes that it would be impossible for these private schools to recover without the government's financial support.

"RR 5-2021 is ill-conceived and insensitive to the realities of the private education sector," the statement read, as it may hamper the distribution of scholarships, loans, and reduced fees to the students.

Further, it imposes a risk of losing jobs and decreasing salaries and benefits on the university personnel and other businesses surrounding the schools.

The statement also emphasized that the grounds of RR 5-2021 highly counter the provisions of the recently signed Republic Act No. 11534 or the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act which reduces the preferential tax treatment from 10% to 1% and the financial requisites of foreign and domestic companies, including the educational institutions.

In addition, the association believes that the regulation refutes the mandates of the Constitution's Article XIV, Sec. 4(3) which exempts the assets of non-profit educational institutions used for its primary purposes from taxes and other duties.

Since the provisions of RR 5-2021 cannot amend the Constitution, the executive branch should reconsider and modify the issuance and its terms.

According to COCOPEA, they have already sought the attention of BIR and the Department of Finance (DoF). However, its call for an urgent response remains pending thus propelling them to release a public request.

The statement, then, appealed to the lawmakers to immediately amend RR 5-2021 and "exercise their taxing power with fairness and equity, and in accordance with both the CREATE Act and the Constitution."

As of writing, Associations of Catholic and Technical-Vocational (Tech-Voc) schools and other Metro Manila private tertiary institutions such as Adamson University (AdU), National University (NU), and Mapúa University have also released their statements regarding the issue.

Founded in 1961, COCOPEA is the country's leading association that unifies the private education sector, securing the development of its 2,500 member colleges, universities, and tech-voc institutions.

-Mary Licel Biscocho

(File photo from Raymond de Dios/FEU Advocate)

Other Stories

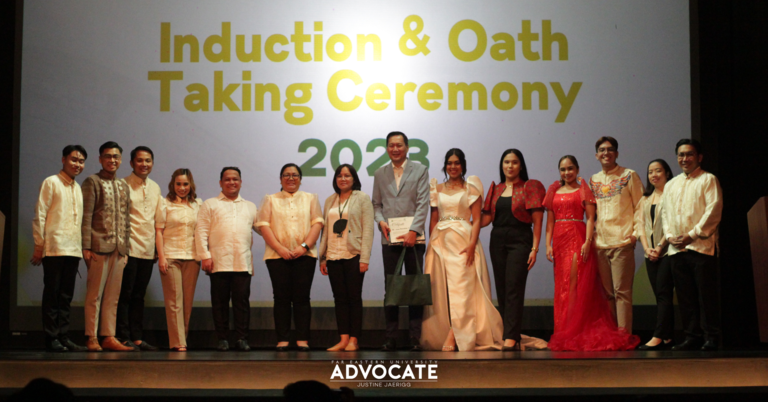

Mga bagong student-lider ng FEU, inaasahang magpakita ng propesyonalismo

August 09, 2023 00:53

FEU drummer shines in local and international competitions for his senior year

January 14, 2021 09:55

FEU taekwondo team bags four medals to end season campaign

December 23, 2022 07:48

Ani ng Dangal awardee to represent PH in int’l competition

March 30, 2023 04:28

Scrapped booths prompt student-led website shop ‘PiyuMart’

February 08, 2024 01:53

Nang Lukubin ng Tsimis ni Marites ang Katotohanan

May 30, 2022 12:24

Ang paglipad ng pluma sa tiranyang mapanyurak

March 24, 2024 13:45

Psych juniors celebrate pinning ceremony, await immersion

March 24, 2024 05:03

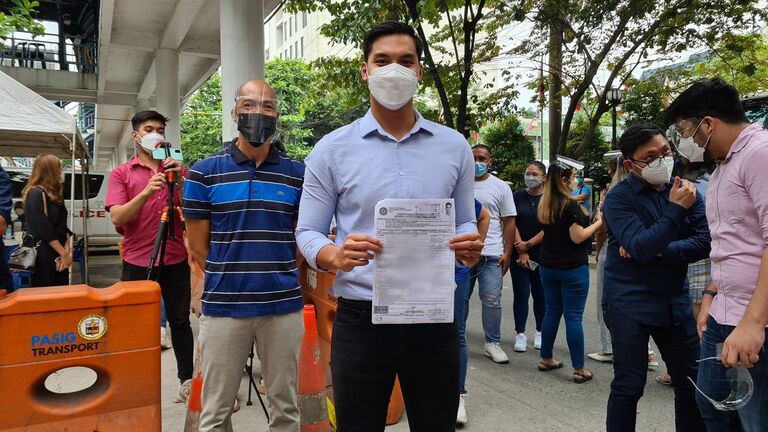

Former FEUCSO president vies for councilor in Pasig

October 11, 2021 03:46

Alleged hacker leaks FEU student portal account details

June 17, 2020 04:13